The recently proposed Republican tax bill has ignited controversy among the nation’s gambling community, as experts and industry leaders warn that the legislation could impose significant financial setbacks on players and operators alike. According to analysis featured in The New York Times,the bill’s provisions may disproportionately disadvantage gamblers by altering tax deductions and reporting requirements,potentially reshaping the landscape of legal gambling in the United States. This development underscores the broader implications of tax reform efforts and their often unforeseen impact on niche sectors.

Republican Tax Bill Alters Gambling Winnings Reporting Requirements

The recent tax legislation has introduced significant modifications to how gambling winnings are reported, drawing sharp criticism from the gambling community and industry experts alike. Under the new rules, the threshold for mandatory reporting on winnings has been lowered substantially, compelling casinos and sportsbooks to report smaller prizes to the IRS.This change effectively increases the tax burden on casual players, as more frequent reporting could lead to higher instances of overlooked taxable income and potential audits.

Key changes include:

- Reporting requirements now apply to winnings exceeding $600, down from the previous $1,200 threshold for slots and bingo.

- Expanded reporting for poker and other table games, including tournaments prizes as low as $300.

- Mandatory handover of personal information for all reported winnings,raising privacy concerns.

| Game Type | Old Reporting Threshold | New Reporting Threshold |

|---|---|---|

| Slots & Bingo | $1,200 | $600 |

| Poker & Table Games | $5,000 (tournament) | $300 (tournament) |

| Sports Betting | $600 | $600 |

Critics argue that these changes complicate routine wins for many gamblers, especially casual bettors, by creating additional paperwork and tax liabilities for smaller amounts that were previously non-reportable. The enhanced oversight could discourage recreational gambling, traditionally a key driver of state revenues, which could unintentionally impact local economies dependent on gaming income.

Impact on Recreational and Professional Gamblers Explored

The new tax legislation poses significant challenges for both recreational and professional gamblers, introducing a tax framework that many argue disproportionately penalizes winning bets. Unlike prior rules that allowed the deduction of gambling losses only up to the amount of winnings, the bill creates a more restrictive surroundings, especially impacting those who rely on gambling as a source of income. Professional gamblers face a heightened tax burden,as losses exceeding winnings are no longer deductible,resulting in potentially devastating financial consequences even in years where their stakes remain high. Recreational players,often considered casual participants,will also see diminished returns on their wagers,potentially dampening enthusiasm and participation over time.

Key effects on gamblers include:

- Reduced deductible losses: Limits decrease the financial viability of gambling as a profession.

- Increased effective tax rates: Winners may now be taxed more heavily, eroding net gains.

- Discouragement of responsible betting: Players may engage in riskier behavior to offset tax penalties.

The table below highlights a simplified comparison of tax impacts before and after the bill’s enactment, illustrating a stark increase in taxable income for both player categories.

| Gambler Type | Deductible Losses (Before) | Deductible Losses (After) | Estimated Tax Increase |

|---|---|---|---|

| Professional | Up to total winnings | Losses capped at winnings, excess disallowed | 25-30% |

| Recreational | Up to total winnings | Losses capped at winnings, stricter reporting | 15-20% |

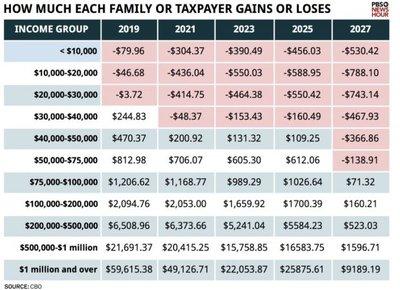

Experts Warn of Increased Financial Strain for Low and Middle-Income Gamblers

The recent tax legislation has raised alarms among financial experts who emphasize the disproportionate impact on low and middle-income gamblers. With changes in tax deductions related to gambling losses, many individuals already struggling to manage their budgets may face increased out-of-pocket expenses. Financial advisors warn that the bill’s structure inadvertently punishes those who are less able to absorb losses, pushing them into a cycle of deeper financial instability.

Key concerns include:

- Decreased ability to offset losses against winnings, reducing net recoveries

- Increased effective tax rates among casual gamblers

- Heightened risk of underreporting due to complexity, leading to possible audits

| Income Bracket | Estimated Increase in Tax Burden | Average Annual Losses Reported |

|---|---|---|

| Under $40,000 | 12% | $1,500 |

| $40,000 – $80,000 | 8% | $3,200 |

| $80,000 – $150,000 | 5% | $4,900 |

Policy Recommendations Aim to Mitigate Negative Effects on Gambling Community

In response to growing concerns from stakeholders within the gambling community, several policy recommendations have emerged that focus on alleviating the adverse impacts of the Republican tax bill. Lawmakers and advocacy groups alike suggest targeted tax relief aimed specifically at small-scale operators and daily recreational gamblers who bear the brunt of increased taxation. These measures include adjusting tax brackets to reduce burdens on low-income gamblers and implementing safeguards to prevent the exclusion of informal gaming venues from relief programs.

Additionally,experts advocate for enhanced transparency and oversight to ensure that tax revenues collected are reinvested into problem gambling prevention and community support services. Below is a summary of the key proposals currently circulating among policymakers:

| Policy Proposal | Expected Impact |

|---|---|

| Flexible Tax Rates Based on Income | Reduce financial strain on lower-income gamblers |

| Reinvestment in Support Programs | Address gambling addiction and community health |

| Tax Relief for Small Operators | Protect local businesses and preserve jobs |

| Improved Regulatory Transparency | Enhance public trust and accountability |

- Promoting equitable tax policies that reflect the diverse economic realities within the gambling sector.

- Ensuring funds serve dual purposes—generating state revenue while supporting public health initiatives.

- Facilitating dialog between regulators and gambling communities to tailor effective and lasting solutions.

Key Takeaways

the Republican tax bill raises significant concerns for gamblers, potentially diminishing their financial advantages and altering the landscape of betting and gaming. As lawmakers push forward with these changes, the impact on both casual and professional gamblers remains a critical issue, warranting close scrutiny and ongoing debate. The implications of this legislation underscore the broader challenges faced by policymakers trying to balance fiscal objectives with the interests of diverse economic groups.