In 2020, the onset of the COVID-19 pandemic brought about unprecedented shifts in the daily lives and habits of Americans, with one of the most profound changes occurring in the way they manage their finances. As lockdowns and social distancing measures took hold across the nation,conventional spending patterns gave way to new priorities and behaviors,reshaping the economic landscape in real time. This article explores how the virus accelerated changes in consumer spending—from a surge in online shopping and a decline in discretionary expenditures to a heightened focus on savings and essentials—offering insight into the evolving American economy amid a global crisis.

Shifts in Consumer Priorities During the Pandemic

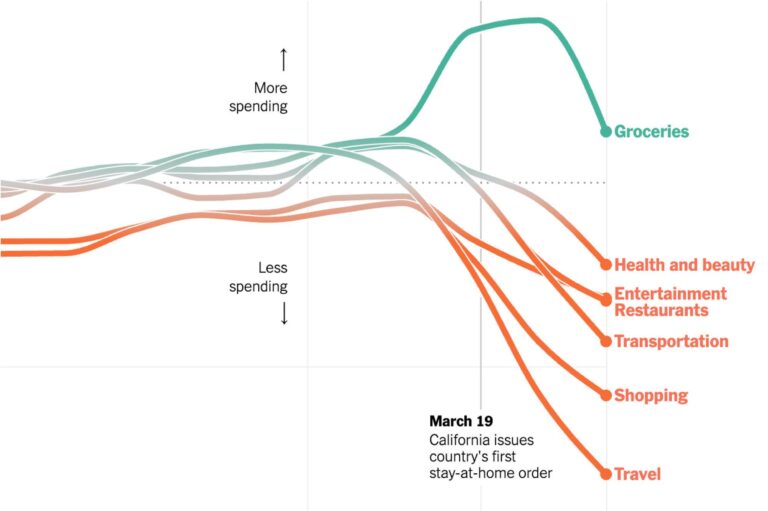

As the pandemic altered daily routines and constrained mobility, American consumers swiftly recalibrated their spending habits. Essential goods like groceries, cleaning products, and personal protective equipment skyrocketed in demand, while discretionary expenses—such as dining out, travel, and entertainment—plummeted. This immediate shift underscored a profound reevaluation of what Americans valued most, prioritizing health, safety, and home stability over leisure and luxury experiences.

Several key consumer priority changes emerged:

- Home-Centric Living: Investment in home betterment, kitchen appliances, and digital entertainment surged as families adjusted to spending more time indoors.

- Health and Wellness: Purchases related to fitness equipment, supplements, and telehealth services saw significant increases.

- Financial Prudence: Savings rates climbed as uncertainty prompted consumers to tighten budgets and delay non-essential purchases.

| Category | Pre-Pandemic Spend | During Pandemic Spend |

|---|---|---|

| Groceries & Essentials | $500/month | $750/month |

| Dining & Entertainment | $400/month | $150/month |

| Home Improvement | $200/month | $350/month |

| Travel & Leisure | $300/month | $50/month |

The Surge of E-Commerce and Contactless Payments

In an unprecedented shift triggered by the global health crisis, Americans rapidly embraced online shopping and contactless payment methods, fundamentally altering the retail landscape. Businesses that once relied heavily on foot traffic saw a dramatic pivot towards digital platforms,with many small and medium enterprises launching or expanding their e-commerce capabilities nearly overnight. This adoption was not just a convenience but a necessity,fueled by social distancing measures and health concerns.Mobile wallets, QR codes, and tap-to-pay technologies became the norm as consumers sought safer, quicker ways to complete transactions without physical contact.

Key trends in the digital payment surge include:

- Explosion in mobile wallet usage: Payments via smartphones increased by over 30% compared to pre-pandemic levels.

- Rise of Buy Now, Pay Later (BNPL) services: Flexible payment options eased consumer hesitation amidst economic uncertainty.

- Enhanced security measures: Contactless payments integrated advanced encryption and biometric authentication to boost user confidence.

| Payment Method | 2019 Usage (%) | 2020 Usage (%) |

|---|---|---|

| Credit/Debit Card Swipe | 56 | 34 |

| Contactless Tap Payments | 18 | 47 |

| Mobile Wallets (Apple Pay, Google Pay) | 12 | 42 |

| Online Bank Transfers | 14 | 28 |

Impact on Small Businesses and Local Economies

Small businesses, often the backbone of local economies, faced unprecedented challenges as consumer behavior shifted dramatically amid the pandemic.Many brick-and-mortar shops experienced steep declines in foot traffic, forcing them to pivot quickly to online sales or curbside pickup options. Essential sectors such as grocery stores and home improvement shops saw a surge in demand, while restaurants and specialty retailers grappled with closures and limited capacity.This adaptation highlighted both vulnerabilities and resilience, as businesses with digital infrastructure or agility managed to sustain revenue streams, whereas others faced permanent shutdowns.

- Rapid digital conversion: Small businesses accelerated e-commerce adoption, with a 40% increase in online sales platforms within months.

- Supply chain disruptions: Local suppliers had to navigate shortages and delays, impacting inventory and costs.

- Community support: Consumers rallied behind neighborhood establishments through increased patronage and gift card purchases.

| Sector | Impact | Recovery Outlook |

|---|---|---|

| Retail | 50% decrease in foot traffic | Gradual recovery over 18 months |

| Restaurants | 70% revenue loss during peak lockdown | Recovery tied to dining restrictions |

| Home Services | 25% increase in demand | Stable growth expected |

Local economies encountered a ripple effect as unemployment surged and discretionary spending tightened.However, these challenges also fostered innovative community initiatives and policy responses aimed at supporting small enterprises. From municipal grants to revitalized ‘shop local’ campaigns, the pandemic spotlighted the critical role of small businesses not just as commercial entities but as cultural and economic anchors. Moving forward, their ability to integrate technology and adapt to evolving consumer preferences will define the trajectory of recovery across towns and cities nationwide.

Strategies for Financial Resilience in Uncertain Times

Amid economic uncertainty, many Americans have rapidly adopted new financial habits that emphasize caution and prioritization. Households are increasingly focusing on building emergency savings, reducing discretionary spending, and seeking option income sources. Digital banking tools and budgeting apps have surged in popularity, empowering users to track expenses closer than ever before.The shift reflects a collective recalibration of what constitutes necessary expenditures,with essentials such as groceries and healthcare taking precedence over luxury items and leisure activities.

Experts recommend several practical measures to bolster financial resilience in turbulent times:

- Enhance liquidity: Maintain a cash reserve covering at least 3-6 months of essential expenses.

- Diversify income streams: Explore part-time work, freelance opportunities, or passive income avenues.

- Optimize spending: Regularly review subscriptions and recurring charges to eliminate non-critical costs.

- Stay informed: Monitor economic trends and government assistance programs for timely support.

| Strategy | Benefit | Implementation Tip |

|---|---|---|

| Emergency Fund | Cushions unexpected disruptions | Automate monthly savings from each paycheck |

| Expense Audit | Identifies wasteful outflows | Use banking apps to categorize expenditures |

| Income Diversification | Reduces dependency on one source | Leverage skills for side gigs |

Closing Remarks

As the nation continues to navigate the ongoing challenges posed by the virus, its impact on consumer behavior remains unmistakable. From a surge in online shopping to a reevaluation of spending priorities, Americans have fundamentally altered the way they manage their finances.While some changes may prove temporary,others could reshape the economic landscape for years to come. Understanding these shifts is essential for businesses,policymakers,and consumers alike as the country adapts to a new financial normal.