UK Exemption Amid Global Steel Tariff Shifts: A New Trade Dynamic

The recent announcement regarding steel tariffs has stirred critically important reactions in international markets, notably excluding the United Kingdom from the newly imposed duties while targeting the European Union with stringent tariffs. This selective tariff application, as reported by The New York Times, places European steel manufacturers under intensified pressure, exacerbating economic frictions amid ongoing trade disputes. While the UK benefits from a tariff-free status post-Brexit, European steel industries confront escalating obstacles that may transform the continent’s steel production landscape and its wider economic partnerships.

Britain’s Advantage in the Tariff Landscape

In the context of rising global trade frictions, the UK stands out by being exempt from the latest U.S. steel import tariffs. This exemption has enabled British steel manufacturers to sustain steadier export flows to North America, sidestepping the financial strain that their European counterparts endure. Industry analysts suggest that this tariff relief could accelerate the recovery trajectory of the UK steel sector following the pandemic, granting it a competitive advantage in a volatile market environment.

Conversely, European steel exporters are contending with the full impact of these tariffs, which have effectively doubled their trade challenges relative to the UK. The consequences include compressed profit margins,accumulating inventory surpluses,and a critical reassessment of supply chain dependencies. These disruptions extend beyond steel producers, affecting industries reliant on cost-effective raw materials. The table below highlights the tariff repercussions on principal European steel-producing nations:

| Country | Export Reduction (%) | Average Tariff Imposed | Industry Response |

|---|---|---|---|

| Germany | 18% | 25% | Advocating for tariff relief |

| France | 15% | 25% | Pivoting to specialized markets |

| Italy | 20% | 25% | Implementing cost reduction strategies |

Challenges Facing European Steel Manufacturers

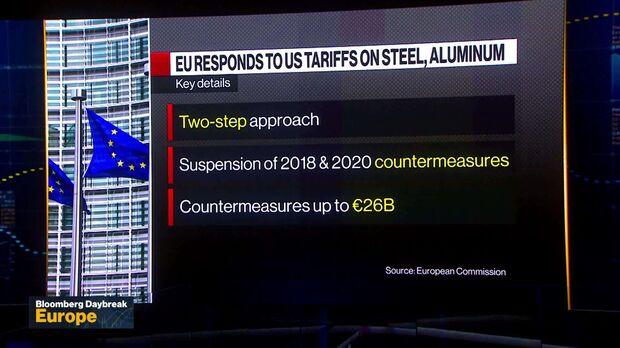

European steel producers are under increasing strain as U.S. tariffs sharply elevate the cost of imported steel. Unlike the UK, which remains exempt, European manufacturers face heightened duties that jeopardize established trade ties and inflate operational costs. Industry leaders caution that the combined effect of these tariffs and retaliatory measures from other nations could severely impact profitability and stall recovery efforts after years marked by market instability.

Among the primary concerns are potential workforce reductions and diminished capital investment in modernization across key steel-producing regions. Experts warn of possible supply chain fragmentation as companies explore alternative sourcing to circumvent steep tariffs, possibly triggering a geographic shift in production away from traditional European hubs. This scenario has prompted calls for unified EU policy initiatives to shield domestic producers while pursuing diplomatic solutions to ease trade tensions.

- Tariff escalation: Approximately 25% hike on steel imports from Europe

- Employment threats: Projected layoffs in major steel manufacturing areas

- Market impact: European steel prices rising by 10-15%

| Country | Steel Export Volume (Million Tons) | Estimated Tariff Cost Increase (%) |

|---|---|---|

| Germany | 35 | 24 |

| France | 12 | 26 |

| Italy | 15 | 23 |

Divergent Government Strategies Amid Rising Steel Costs

In reaction to inflationary pressures and supply chain challenges, European governments have deployed a variety of measures to mitigate economic shocks. While the UK has refrained from imposing steel tariffs, most EU member states have introduced protective policies, including elevated import duties and financial subsidies for domestic steelmakers. These interventions aim to shield local industries but risk increasing raw material expenses for downstream sectors, potentially hindering broader economic recovery.

Policy responses vary widely, encompassing tariff adjustments, fiscal stimulus, and regulatory reforms, reflecting a fragmented approach across Europe. Some countries emphasize direct financial assistance to affected firms, whereas others prioritize labor market versatility to preserve jobs. The table below summarizes key government actions and their influence on steel prices as of mid-2024:

| Country | Tariff Rate | Subsidies Allocated | Steel Price Increase |

|---|---|---|---|

| Germany | 15% | €500 million | 12% |

| France | 18% | €350 million | 15% |

| Italy | 20% | €420 million | 17% |

| UK | 0% | €0 | 5% |

- Germany: Balancing industry protection with export competitiveness.

- France: Focused subsidies supporting eco-amiable steel production.

- Italy: Combining higher tariffs with workforce support programs.

- UK: Emphasizing market openness over protectionist policies.

Strategies for European Steel Industry to Counter Tariff Pressures

To alleviate the adverse effects of compounded tariffs, European steelmakers must urgently broaden their export horizons beyond traditional U.S. and intra-European markets. Expanding trade relations with emerging economies in Asia,Africa,and Latin America could unlock new growth opportunities. Additionally, investing in sustainable steel production technologies offers a dual advantage: meeting rising global demand for environmentally friendly materials and enhancing competitiveness against tariff-affected rivals.

European governments are instrumental in supporting this transition through targeted policies such as financial aid packages, streamlined customs operations, and the establishment of innovation centers focused on advanced metallurgy. The following table outlines key strategic initiatives alongside their anticipated benefits:

| Strategy | Expected Benefit |

|---|---|

| Expand Export Destinations | Reduce reliance on limited markets, enhance resilience |

| Adopt Green Steel Technologies | Achieve regulatory compliance, gain market differentiation |

| Enhance Government Support | Provide financial stability, stimulate innovation |

| Optimize Customs Procedures | Lower costs, improve supply chain efficiency |

Conclusion: European Steel Sector at a Crossroads

As Europe contends with the economic reverberations of steel tariffs, the UK’s exemption offers a temporary advantage amid persistent trade tensions. This divergence highlights the intricate nature of global trade policies and their uneven regional impacts. Moving forward, stakeholders on both sides of the Channel must navigate these complexities carefully, as the evolving situation serves as a crucial indicator of the broader transatlantic economic relationship’s future trajectory.