The US Initial Public Offering (IPO) market is signaling a robust resurgence as fintech challenger Chime made a striking debut on the public markets,surging well beyond initial expectations. This pivotal moment, reported by Reuters, underscores growing investor confidence and renewed enthusiasm for newly listed companies after a sustained period of market hesitation. Chime’s triumphant IPO may mark the beginning of a broader revival in the US equity debut landscape, with industry watchers closely monitoring for signs of sustained momentum.

US IPO Market Gains Momentum Driven by Chime’s Strong Debut

The latest debut by fintech challenger Chime has injected a fresh wave of enthusiasm into the US IPO landscape, signaling a broader revival after a challenging period marked by market volatility and investor caution. With shares surging in early trading, Chime’s performance underscores robust demand for innovative financial technology firms poised to disrupt customary banking. This momentum is prompting both established giants and emerging startups to reconsider public offerings, hoping to capitalize on renewed investor confidence.

Key factors contributing to this uptick include:

- Strong investor appetite: Confidence in growth-oriented fintechs has surged following Chime’s impressive valuation gains.

- Favorable market conditions: Stabilizing economic indicators and easing inflation pressures provide a conducive backdrop.

- Increased retail participation: Elevated interest from individual investors supporting IPO subscriptions.

| Company | Debut Date | First Day Gain |

|---|---|---|

| Chime | June 10, 2024 | +22% |

| FinTechX | April 15, 2024 | +8% |

| PayFlow | March 5, 2024 | +5% |

Investor Confidence Rebounds Amid Renewed Appetite for Tech Listings

The surge in demand for tech IPOs signals a renewed optimism among market participants, reversing the cautious sentiment that dominated recent quarters. The strong debut of fintech unicorn Chime, which soared well beyond expectations, underscores investors’ growing confidence in digital innovation and disruptive business models. This rebound is further fueled by a favorable macroeconomic environment and increased liquidity, creating fertile ground for tech startups to access public markets more readily.

Key factors contributing to this resurgence include:

- Robust valuation multiples: Tech companies are commanding premium pricing compared to other sectors.

- Enhanced regulatory clarity: Streamlined listing requirements have lowered barriers for high-growth firms.

- Strong retail investor interest: The retail segment is actively participating, buoyed by accessible trading platforms.

| IPO Highlight | Chime Debut |

|---|---|

| Opening Price | $30 |

| Closing Price | $45 |

| Market Valuation | $14.5B |

| Shares Sold | 50M |

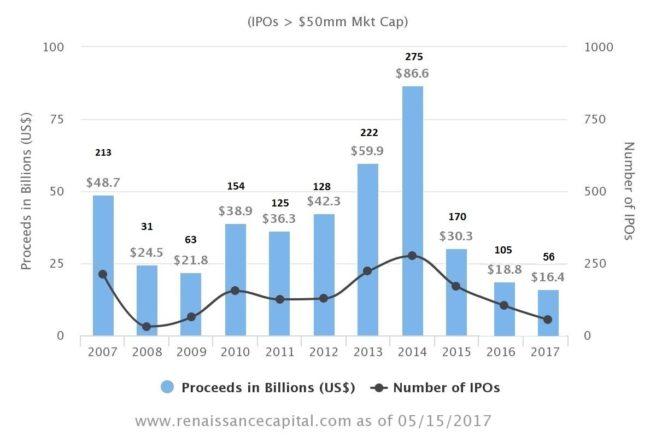

Key Factors Behind the Resurgence of US Initial Public Offerings

The US IPO market has experienced a notable revival, buoyed by a convergence of favorable economic conditions and renewed investor confidence.The debut of fintech challenger Chime, which saw its shares surge well above initial pricing, has acted as a catalyst, signaling robust demand for fresh public offerings. Key drivers include a recovering economy post-pandemic, improving corporate earnings, and a stable interest rate environment that encourages risk-taking. Additionally, the rise of tech innovation and digital conversion has flooded the pipeline with promising companies eager to capitalize on growth capital through public listings.

Several intertwined factors have contributed to this resurgence:

- Regulatory easing: Streamlined processes have reduced hurdles and boosted IPO readiness.

- Investor appetite: Renewed interest from institutional and retail investors in high-growth sectors.

- Market volatility stabilization: A calmer volatility landscape has reassured issuers and underwriters.

- Strong performance of recent IPOs: Success stories like Chime’s have increased market optimism.

| Factor | Impact on IPO Market |

|---|---|

| Economic Recovery | Increases capital availability and risk tolerance |

| Tech Sector Growth | Attracts innovative companies to go public |

| Investor Confidence | Boosts demand for new listings |

| Regulatory Changes | Speeds up listing process and lowers costs |

Strategies for Companies Eyeing Successful IPOs in a Revitalized Market

Companies preparing for public offerings must focus on building strong fundamentals that resonate with today’s discerning investors. This means demonstrating clear pathways to profitability and enduring growth, coupled with obvious governance practices. Providing detailed guidance on revenue forecasting and highlighting unique market positioning will be crucial in attracting institutional and retail investors alike. Additionally, firms should prioritize effective dialog strategies to maintain investor confidence amid market fluctuations, leveraging digital channels and investor relations tools to foster ongoing engagement.

Another critical component involves meticulous timing and market awareness. Firms must monitor broader economic indicators and sector-specific trends to identify optimal windows for launching their IPOs. Accelerated due diligence and regulatory compliance also play essential roles in smoothing the path to a successful debut. Below is a concise checklist to help companies align their IPO readiness with market dynamics:

- Robust Financial Health: Demonstrate consistent revenue growth and profitability metrics.

- Clear Value Proposition: Communicate competitive advantages and long-term vision.

- Regulatory Preparedness: Ensure all disclosures and compliance protocols are up-to-date.

- Market Timing: Assess broader market sentiment and economic cues.

- Investor Outreach: Develop transparent, proactive communication channels.

| Strategy | Key Focus | Expected Impact |

|---|---|---|

| Financial Transparency | Accurate reporting and forecasts | Builds trust and credibility |

| Market Analysis | Sector trends and timing | Maximizes valuation and interest |

| Investor Relations | Proactive communication | Enhances long-term engagement |

| Regulatory Compliance | Up-to-date filings | Reduces delays and risk |

In Retrospect

As Chime’s strong debut signals renewed investor confidence, the US IPO market appears poised for a broader resurgence after a prolonged period of stagnation. While challenges remain amid economic uncertainties, the recent momentum offers a promising outlook for companies seeking public listings and for investors eager to capitalize on emerging opportunities. Market watchers will be closely monitoring whether this revival can sustain itself in the months ahead.