Stocks edged lower and U.S.Treasury yields climbed as investors digested fresh economic data alongside comments from Federal Reserve Chair Jerome Powell. Market participants weighed signals on inflation and monetary policy outlooks, prompting cautious trading across equity and bond markets. The developments reflect ongoing uncertainties as the Fed’s next moves remain closely scrutinized by financial markets.

Stocks Retreat Amid Mixed Economic Data and Hawkish Powell Remarks

Markets responded cautiously following the latest economic releases, which painted a mixed picture of the U.S.economy’s health. While certain indicators showed resilience, concerns grew over potential headwinds impacting growth trajectories. Investors digested figures that ranged from moderate job gains to softer-than-expected retail sales, signaling uneven momentum in key sectors.

Key market reactions included:

- Major stock indices experiencing mild declines as traders reassessed risk appetite

- U.S. Treasury yields climbing, reflecting expectations for sustained monetary tightening

- Volatility rising amid uncertainty over the Federal Reserve’s next moves

| Indicator | Latest Result | Market Expectation |

|---|---|---|

| Nonfarm Payrolls | 263,000 | 250,000 |

| Retail Sales (MoM) | -0.3% | 0.1% |

| 10-Year Treasury Yield | 4.12% | 4.05% |

Additionally, Federal Reserve Chair Jerome Powell’s remarks reinforced an unwavering stance on inflation control, emphasizing the necessity of “additional policy firming” if inflation risks persist. This hawkish tone spurred caution among investors, provoking reassessments of asset valuations in a climate of potentially extended interest rate hikes.

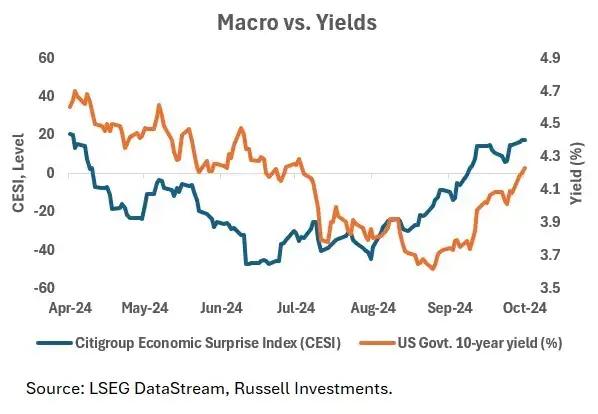

Rising US Treasury Yields Signal Investor Concerns Over Inflation Outlook

Investors are reacting sharply to the uptick in US Treasury yields,reflecting growing unease about the trajectory of inflation in the coming months. Yields on 10-year notes have climbed steadily, underscoring a market expectation that the Federal Reserve may maintain or even accelerate tightening measures to combat persistent price pressures. Key drivers influencing this trend include recent economic data releases and Federal Reserve Chairman Jerome Powell’s latest remarks,which have signaled caution and a readiness to keep policy restrictive if inflation remains elevated.

The bond market’s sensitivity to inflation concerns has triggered a notable shift in asset allocation strategies among traders. Market participants are increasingly factoring in:

- Prospective interest rate hikes limiting bond price gratitude.

- Equity market volatility

- Global supply chain disruptions

| Asset | Performance Today | Key Driver |

|---|---|---|

| 10-Year US Treasury Yield | +0.18% | Inflation expectations |

| S&P 500 | -0.65% | Fed comments, data uncertainty |

| Consumer Price Index | +0.4% (MoM) | Continued supply constraints |

Market Experts Advise Caution as Volatility Persists in Equity and Bond Markets

Recent market movements reflect an atmosphere of uncertainty as investors weigh the implications of incoming economic data alongside Federal Reserve Chair Jerome Powell’s remarks. Equity markets experienced modest declines amid rising U.S. Treasury yields, signaling a cautious sentiment among traders navigating mixed signals on inflation and growth prospects.Experts stress that the current environment demands vigilance, as the interplay between monetary policy expectations and economic fundamentals continues to drive pronounced fluctuations.

Key factors influencing market sentiment include:

- Higher-than-expected inflation figures intensifying concerns over sustained rate hikes.

- Strong employment data bolstering confidence in economic resilience.

- Geopolitical tensions adding layers of unpredictability in global markets.

| Asset Class | Recent Trend | Market Outlook |

|---|---|---|

| Equities | Slip in major indices | Volatile, selective buying advised |

| U.S. Bonds | Yields on the rise | Sell-off pressure expected to persist |

Strategic Portfolio Adjustments Recommended Amid Uncertain Federal Reserve Signals

Market participants are urged to revisit their positions as ambiguity in recent Federal Reserve communications fuels volatility. Investors are advised to consider reallocating assets with a focus on risk mitigation, given the unpredictable trajectory of interest rates. Key sectors such as technology and consumer discretionary may experience elevated sensitivity, prompting a tactical shift towards more defensive stocks and fixed-income instruments.

- Increased allocation to Treasuries: To hedge against potential market downturns.

- Selective equity exposure: Prioritizing sectors with stable earnings and strong balance sheets.

- Diversification into alternatives: Including commodities and real estate to buffer against inflation risks.

| Asset Class | Recommended Action | Rationale |

|---|---|---|

| U.S. Equities | Trim exposure | Valuation pressure and rate sensitivity |

| Government Bonds | Increase allocation | Flight to safety amid uncertainty |

| Commodities | Maintain or increase | Inflation hedge and diversification |

Insights and Conclusions

As markets digest the latest economic data and Federal Reserve Chair Jerome Powell’s remarks,investors remain cautious amid signals of a tightening monetary landscape. The modest pullback in stocks and the uptick in US Treasury yields underscore ongoing uncertainties surrounding inflation and growth prospects. Market participants will be closely watching upcoming data releases and Fed communications for further clues on the path of interest rates and economic momentum.