In a move that has sent ripples through global markets, former President Donald Trump’s tariff policies continue to reshape the landscape of trade in Asia, potentially sidelining the United States from critical economic partnerships. As nations in the region recalibrate their supply chains and alliances in response to ongoing trade tensions, experts warn that Washington risks undermining its influence and access in one of the world’s fastest-growing markets. This article examines how Trump-era tariffs are prompting a realignment of Asian trade networks and raises questions about the long-term implications for U.S. economic leadership.

Trump’s Tariffs Reshape Asian Supply Chains and Shift Economic Alliances

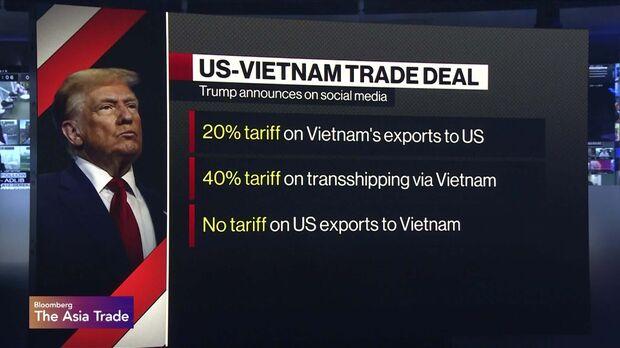

As tariffs imposed during the Trump administration continue to ripple through global markets, Asian manufacturers are aggressively restructuring supply chains to circumvent U.S. tariffs.Countries like Vietnam, Thailand, and Malaysia have seen a surge in foreign direct investment, serving as option production hubs to maintain market access without incurring additional costs. This strategic pivot has not only altered manufacturing footprints but also intensified regional competition, prompting Southeast Asian nations to deepen intra-Asia trade partnerships and reduce dependency on American markets.

Key outcomes of these shifts include:

- Increased regional trade agreements between Asian economies

- Growth in cross-border logistics and infrastructure investment

- Emergence of new tech and manufacturing clusters independent of U.S. supply lines

| Country | FDI Growth (%) | Top Export Shift |

|---|---|---|

| Vietnam | 25% | Electronics Assembly |

| Thailand | 18% | Automotive Components |

| Malaysia | 20% | Semiconductor Parts |

Emerging Trade Blocs in Asia Challenge U.S. Economic Influence

As countries across Asia forge new trade agreements, a visible shift is underway that threatens to diminish the longstanding economic predominance of the United States in the region. These emergent blocs are designed to foster closer economic ties among member nations,emphasizing tariff reductions,regulatory harmonization,and shared infrastructure projects. By excluding the U.S., these alliances not only strengthen regional interdependence but also create alternative supply chains that bypass American markets.

Key factors fueling this realignment include:

- Rising economic nationalism: Governments seeking to protect local industries are championing collective regional interests over global free trade models favored by the U.S.

- Strategic diversification: Companies within Asia are keen to reduce reliance on unpredictable U.S. policies by deepening trade relations with neighbors.

- Technological collaboration: Innovation hubs within these blocs promote shared advancements,making the coalition increasingly self-sufficient.

| Trade Bloc | Member Countries | U.S. Participation |

|---|---|---|

| Regional Extensive Economic Partnership (RCEP) | 15 Asian-Pacific countries | No |

| Asia-Pacific Economic Cooperation (APEC) | 21 Pacific Rim economies | Yes, but less influential recently |

| Bay of Bengal Initiative (BIMSTEC) | 7 South and Southeast Asian nations | No |

Impact on American Businesses and Consumer Prices Revealed

The imposition of tariffs under the Trump administration has had a pronounced effect on American businesses, reshaping supply chains and increasing operational costs. Many U.S. manufacturers have reported higher expenses due to tariffs on imported materials, which are often passed on to consumers in the form of increased prices. This ripple effect challenges the competitive edge of American companies in both domestic and global markets. Moreover, smaller businesses lacking the leverage to absorb these additional costs face significant hardships, forcing some to reconsider expansion plans or shift operations overseas.

Consumers, simultaneously occurring, have felt the impact in everyday expenses, with prices rising on widely used goods ranging from electronics to household appliances. Analysis reveals a noticeable shift in sourcing strategies, as companies seek alternatives to avoid tariff penalties, sometimes turning to Asian markets less exposed to these trade restrictions. The evolving landscape suggests that while tariffs aim to protect domestic industries, they also encourage broader trade realignments that may exclude the U.S.from emerging supply networks.

- Increased manufacturing costs due to tariffs on raw materials

- Higher retail prices impacting consumer budgets

- Shift in supplier choices towards tariff-free Asian countries

- Pressure on small and medium-sized enterprises to adapt or relocate

| Sector | Average Price Increase | Supply Chain Impact |

|---|---|---|

| Electronics | 8.5% | Supply delays, sourcing shifts |

| Automotive | 5.3% | Increased cost of parts |

| Household Goods | 6.7% | Price hikes, inventory adjustments |

| Apparel | 7.1% | Production relocation |

Strategies for U.S. Policymakers to Reengage with Asian Markets

The U.S. must adopt a multifaceted approach to restore its influence in Asian markets amid rising protectionism and shifting regional alliances. Key strategies include strengthening bilateral trade agreements with emerging economies and reinforcing partnerships through multilateral frameworks like the Indo-Pacific Economic Framework (IPEF).Policymakers should prioritize flexibility, allowing for tailored agreements that address the unique economic landscapes of Asian countries rather than a one-size-fits-all tariff regime. Additionally, enhancing regulatory cooperation, intellectual property protections, and digital trade standards will foster a more conducive surroundings for U.S. firms.

Economic diplomacy can also serve as a vital tool. The U.S. should increase investments in technological innovation and infrastructure projects that connect Asia to American markets, creating interdependencies that discourage exclusionary trade practices. Below is a snapshot of potential focus areas for U.S. engagement:

- Supply Chain Resilience: Collaborate on diversifying supply chains away from overdependence on single nations.

- Green Technology: Lead joint initiatives to develop enduring energy solutions with Asian partners.

- Market Access: Negotiate tariff reductions on high-growth sectors like semiconductors and biotechnology.

- Workforce Progress: Support skill-building programs to align with evolving industry needs.

| Strategy | Impact | Urgency |

|---|---|---|

| Enhance Bilateral Agreements | Improved market access and reduced trade barriers | High |

| Invest in Digital Infrastructure | Strengthened cross-border e-commerce and data flows | Medium |

| Supply Chain Diversification | Reduced risks and increased resilience | High |

To Conclude

As the ramifications of Trump’s tariffs continue to ripple across the global economy,the reshaping of Asia’s trade networks appears increasingly unavoidable. With key regional players diversifying their partnerships and supply chains to circumvent U.S. trade barriers, Washington risks marginalizing itself from the very markets it once sought to dominate. The evolving dynamics underscore a critical juncture for American trade policy, where recalibration might potentially be essential to maintain influence in the rapidly transforming Asia-Pacific economic landscape.