The U.S. economy contracted in the first quarter of the year, according to official reports released this week, signaling a setback for growth amid ongoing uncertainties. However, economists caution that the initial reading is complicated by volatile and inconsistent trade data, which may obscure the true state of economic activity. As analysts sift through the conflicting facts, questions remain about the durability of the recovery and the factors influencing short-term fluctuations in the nation’s gross domestic product.

U.S. Economic Growth Slows Amid Conflicting Trade Figures

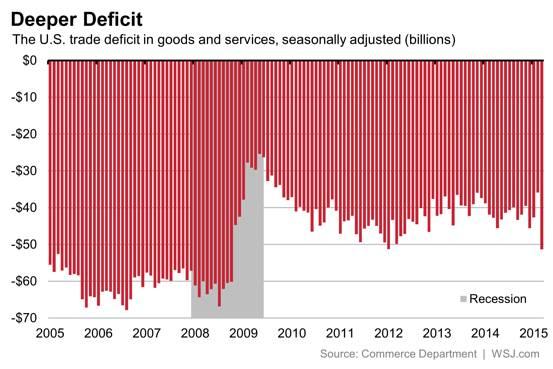

Recent economic reports reveal a slowdown in the U.S. economy during the first quarter, contrasting sharply with earlier optimistic projections. The complexity arises primarily from conflicting trade data, which has muddled initial assessments of growth. While domestic consumer spending remained relatively steady, the drag from trade imbalances and shrinking exports contributed significantly to the downturn. Analysts point to unexpected shifts in import and export figures, complicating the overall economic picture and casting uncertainty on forecasts for the coming months.

Key factors influencing the revised growth numbers include:

- Volatile trade statistics: Inconsistent reports on trade flows have created a foggy outlook on external demand.

- Supply chain disruptions: Lingering effects from global disturbances affecting manufacturing and trade volumes.

- Fluctuating consumer confidence: Mixed signals from household spending patterns driven by inflation pressures.

The table below summarizes core economic indicators related to the growth slowdown:

| Indicator | Q1 2024 | Q4 2023 |

|---|---|---|

| GDP Growth Rate | +0.2% | +2.1% |

| Exports | -$15B | -$7B |

| Imports | +$22B | +$13B |

Trade Data Discrepancies Complicate Economic Analysis

Economists face mounting challenges in interpreting the latest economic figures due to inconsistencies in trade data. The complexities arise from conflicting reports on imports and exports, which directly influence the calculation of gross domestic product (GDP). As an example, adjustments to trade balances have forced analysts to revise growth estimates multiple times, obscuring the true state of economic activity during the first quarter.

Key factors contributing to the discrepancies include:

- Late-arriving shipment data causing retroactive adjustments

- Variations in reporting standards between government agencies

- Fluctuations in service sector trade measurements

- Disruptions in supply chains affecting timing of recorded transactions

| Trade Component | Reported Q1 Change | Revised Q1 Change |

|---|---|---|

| Exports | -3.2% | -2.4% |

| Imports | +4.5% | +6.1% |

| Net Trade Impact | -0.8% | -1.5% |

Impact of Shrinking Economy on Policy and Market Expectations

The recent contraction in the U.S. economy has introduced meaningful uncertainties into both policy circles and market expectations. Policymakers are now confronted with mixed signals, as the decline is partially attributed to volatile and messy trade data rather than underlying structural weaknesses. This ambiguity complicates the Federal Reserve’s outlook on interest rate adjustments, perhaps stalling or altering planned hikes until more consistent economic indicators emerge. Markets are responding with heightened volatility, reflecting investor nervousness about growth prospects and future fiscal measures.

- Dovish leanings: Some policymakers advocate for a pause, emphasizing caution amid uneven data.

- Data dependency: Future moves hinge heavily on upcoming trade figures and consumer spending reports.

- Market reactions: Equities and bond yields have shown choppy behaviour as investors recalibrate risk.

| Factor | Effect on Policy | Market Response |

|---|---|---|

| Trade Data Volatility | Increased uncertainty, delayed decisions | Higher bond yield volatility |

| GDP Shrinkage (Q1) | Pressure to maintain accommodative stance | Equity market dips, cautious sentiment |

| Consumer Spending | Key indicator for tightening pace | Watch for shifts in investor confidence |

Strategies for Navigating Uncertainty in Economic Reporting

In the aftermath of conflicting signals from recent trade data, economists and analysts are adopting a more nuanced approach to interpreting quarterly economic reports. Given the volatility and revisions typically seen in trade statistics, relying solely on headline GDP figures can lead to premature conclusions. Emphasizing broader economic indicators such as employment trends, consumer spending, and industrial output provides a more balanced viewpoint that offsets the noise created by erratic trade flows.

To better navigate these complexities, experts recommend the following:

- Cross-referencing multiple data sets: Comparing trade data with manufacturing and service sector indices to gauge underlying economic health.

- Examining long-term trends: Avoiding knee-jerk reactions to single-quarter shrinkage by focusing on multi-quarter performance patterns.

- Accounting for seasonal and geopolitical factors: Adjusting expectations around disruptions like tariffs, supply chain bottlenecks, and policy shifts.

| Indicator | Recent Trend | Impact on Outlook |

|---|---|---|

| Consumer Spending | Moderate Growth | Supports Resilience |

| Manufacturing Output | Decline | Causes Concern |

| Trade Balance | Highly Volatile | Increases Uncertainty |

to sum up

As the U.S. economy contracted unexpectedly in the first quarter, analysts caution that the full picture remains obscured by inconsistent trade data and other measurement challenges. While the initial reading underscores mounting economic uncertainties, especially amid ongoing global trade complexities, economists emphasize the need for revised figures and further data to clarify the trajectory ahead. Policymakers and market watchers will be closely monitoring upcoming reports to better gauge the health of the nation’s economic recovery in the months to come.