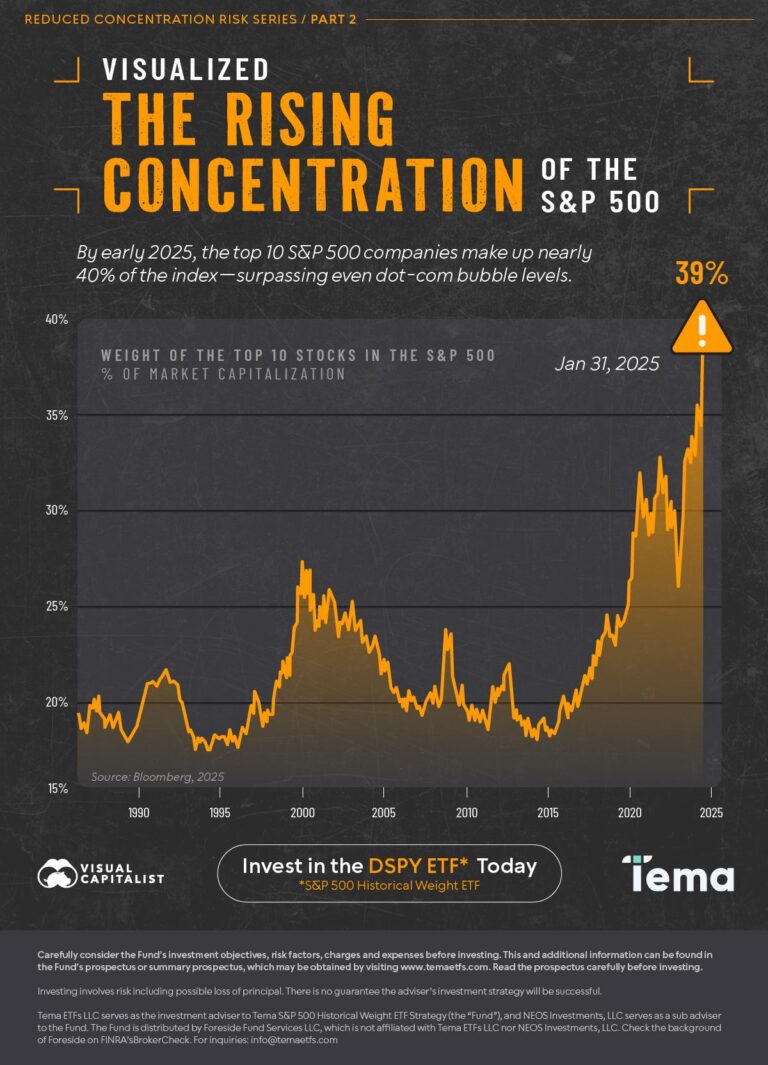

The concentration risks within the US stock market have come into sharp focus as earnings reports from major megacap companies roll in, Reuters reports. With a handful of technology giants dominating market capitalization and investor sentiment, analysts and market participants are closely scrutinizing the impact of these companies’ financial results on broader market dynamics. The latest earnings season underscores the extent to which the performance of a few industry leaders can sway indices and investor confidence, raising questions about market resilience and diversification in an increasingly top-heavy investment landscape.

US Stock Market Vulnerability Exposed by Megacap Earnings Reports

The recent earnings reports from the largest U.S. technology companies have laid bare the significant concentration risks lurking within the stock market. Investors, who have long relied on megacap giants for steady gains, now face uncertainty as these companies grapple with slowing revenue growth and mounting regulatory pressures. Market analysts warn that the outsized impact of these titans means their underperformance could drag broad indexes down,amplifying volatility across sectors.

Key vulnerabilities highlighted include:

- Overreliance on a handful of companies to drive market gains

- Potential ripple effects if earnings disappointments persist

- Heightened investor sensitivity to regulatory developments

| Megacap | Revenue Growth Q1 (%) | Market Impact |

|---|---|---|

| Apple | 2.5 | High |

| Microsoft | 3.1 | Moderate |

| Alphabet | 1.8 | High |

| Amazon | 2.0 | Moderate |

Investor Concerns Rise Over Concentration Risks in Leading Tech Giants

Market participants are increasingly scrutinizing the potential risks associated with the high concentration of market capitalization held by a handful of tech giants. As the latest earnings reports roll in, the volatility in these mega-cap stocks has reignited debates over systemic vulnerabilities in the US equity market. Investors worry that over-dependence on these few titans could amplify downturns, especially if regulatory pressures or unexpected earnings disappointments arise.

Key concerns include:

- Disproportionate influence on major indices, skewing overall market performance.

- Potential for correlated sell-offs leading to broader market instability.

- The challenge of achieving diversified portfolios amidst skyrocketing valuations.

| Company | Market Cap (Trillion $) | Q1 Earnings Growth (%) |

|---|---|---|

| Tech Giant A | 2.5 | 8.7 |

| Tech Giant B | 2.1 | 6.3 |

| Tech Giant C | 1.8 | 5.9 |

Market Analysts Advise Diversification to Mitigate Sector-Specific Exposure

Market experts underscore the growing necessity for investors to reduce overreliance on a handful of large-cap stocks, particularly as earnings reports from tech giants showcase volatility and uneven growth patterns. The concentration of market value in these megacaps amplifies risks that are unique to specific sectors, which can lead to disproportionate portfolio impacts if negative developments occur. To safeguard against these risks,analysts recommend embracing a well-rounded approach that spreads holdings across diverse industries.

Key diversification strategies highlighted by analysts include:

- Broad sector allocation: Balancing investments across technology, healthcare, finance, consumer goods, and energy sectors.

- Inclusion of mid and small-cap stocks: Adding companies with varying market capitalizations to reduce dependence on megacaps.

- Geographic diversification: Exploring international markets to mitigate U.S.-centric sector risks.

- Alternative assets: Incorporating bonds, real estate investment trusts, and commodities to cushion against equity market downturns.

| Sector | Typical Risk Factors | Diversification Benefit |

|---|---|---|

| Technology | Innovation cycles, regulatory changes | Volatility mitigation |

| Healthcare | Regulatory approvals, patent cliffs | Stable dividends |

| Finance | Interest rates, credit defaults | Income generation |

| Energy | Commodity price swings | Inflation hedge |

Regulatory Scrutiny Intensifies Amid Growing Influence of Megacap Stocks

Recent earnings reports from the largest U.S. technology companies have sparked renewed debate among regulators and market watchers about the potential risks posed by market concentration. As megacap stocks continue to dominate trading volumes and overall market capitalization, concerns are mounting over their outsized influence on price revelation and capital allocation. Regulatory bodies are now evaluating whether existing frameworks sufficiently address the potential systemic vulnerabilities that such concentration introduces, including reduced competition and increased market volatility.

Key issues driving regulatory focus include:

- Antitrust implications as a handful of firms control a considerable share of their sectors.

- Market liquidity risks stemming from dependence on megacap performance.

- Transparency challenges related to disclosure of complex business models and interdependencies.

- Potential impacts on retail and institutional investor behavior given limited diversification.

| Metric | Megacap Average | Market Average |

|---|---|---|

| Market Cap % of Total | 45% | 100% |

| Trading Volume % | 60% | 100% |

| Volatility Index | 12 | 18 |

Final Thoughts

As megacap companies reveal their latest earnings, concerns over US stock market concentration risks have gained renewed attention. Investors and regulators alike are closely monitoring how the dominance of a handful of large-cap firms continues to influence market dynamics and economic resilience. The unfolding earnings season will likely provide further insights into the potential vulnerabilities posed by this concentrated market structure, underscoring the need for balanced diversification and vigilant oversight moving forward.