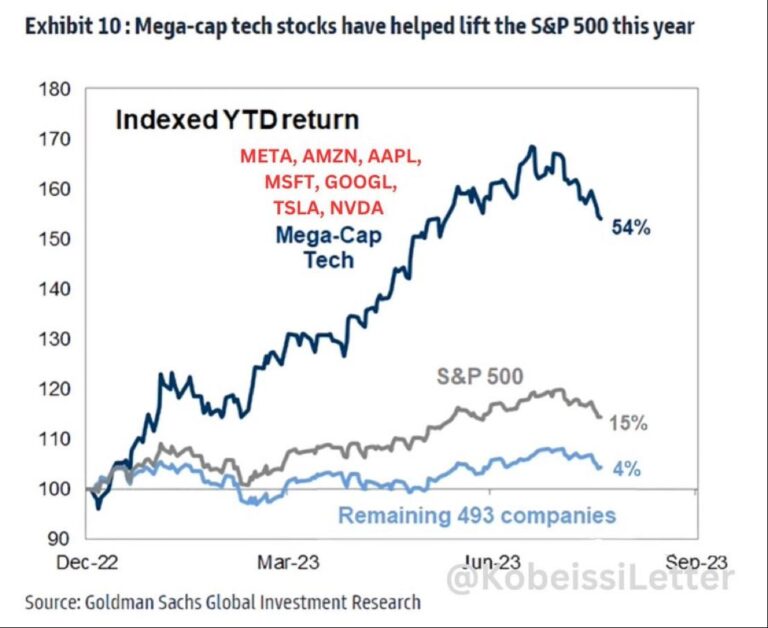

In early trading Thursday, megacap stocks surged as investor appetite for large-cap technology and growth shares intensified, while the U.S. dollar’s recent rally showed signs of easing. According to Reuters’ Morning Bid report, this shift reflects a recalibration in market sentiment amid evolving economic data and central bank signals. The interplay between the powerful megacaps and currency movements is setting the tone for broader market dynamics as investors weigh the outlook for corporate earnings and monetary policy.

Megacaps Lead Market Rally Amid Optimism

Major technology giants

Meanwhile, the U.S. dollar’s rapid ascent moderated, easing pressure on exporters and cyclical sectors. Market participants reacted to mixed signals from economic data and central bank commentary, creating a more balanced currency surroundings. The combination of tech strength and dollar stabilization supported a broad-based risk-on sentiment, benefitting sectors such as consumer discretionary, communication services, and semiconductors.

- Tech earnings beats: Solid revenue growth and expanding margins.

- Dollar outlook: Cooling after recent sharp advances.

- Sector rotation: Shift towards growth stocks on optimism.

| Index | Gain (%) | Lead Sector |

|---|---|---|

| Nasdaq Composite | 1.8 | Technology |

| S&P 500 | 1.2 | Consumer Discretionary |

| Dow Jones | 0.9 | Industrials |

Dollar Surge Eases Pressures on Global Assets

The recent appreciation of the U.S.dollar has brought a welcome relief to strained global markets, calming the volatility that had gripped asset prices worldwide.Investors have responded positively as the stronger dollar mitigates inflationary pressures and stabilizes capital flows, which has notably benefited emerging market equities and commodities. Key financial hubs saw a reduction in speculative outflows, signaling renewed confidence among global investors.

Market Highlights:

- Emerging market stocks rallied by up to 3% following the dollar’s advance.

- Commodity prices showed signs of stabilization after weeks of decline.

- Bond yields in developed economies eased, reflecting reduced risk premiums.

| Asset Class | Change (1 week) | Impact |

|---|---|---|

| Emerging Market Equities | +3.1% | Positive inflows |

| Commodities | +1.5% | Price stabilization |

| Global Bonds | -0.8% | Yield moderation |

Tech Sector Shows Resilience as Investors Weigh Valuations

Despite recent market jitters, the technology sector has demonstrated remarkable stability, buoyed by strong earnings reports and robust demand for cloud computing and artificial intelligence solutions. Major tech giants, frequently enough referred to as megacaps, have led the rally, with investors increasingly drawn to their substantial cash reserves and innovative pipelines. This resilience has sparked renewed interest among portfolio managers who are carefully balancing the sector’s growth potential against historically high valuations.

Investor sentiment remains cautiously optimistic as the US dollar’s recent surge shows signs of cooling, reducing pressure on multinational tech firms’ overseas revenues. Key factors sustaining the sector’s momentum include:

- Strong earnings beats from leading companies

- Accelerated adoption of AI-driven products and services

- Stabilizing commodity prices lowering operational costs

| Company | Q1 Earnings Growth | Stock Performance YTD |

|---|---|---|

| AlphaTech | +18% | +12% |

| BetaSoft | +25% | +15% |

| GammaCloud | +22% | +20% |

Strategic Moves Recommended for Navigating Volatile Currency Trends

Investors should consider diversifying currency exposure to mitigate risks associated with abrupt foreign exchange fluctuations. Prioritizing assets in stable economies and leveraging currency-hedged investment vehicles can help protect capital during periods of heightened volatility. Additionally, keeping a close watch on central bank policies and geopolitical developments is critical, as these factors frequently enough act as catalysts for sudden currency moves.

- Implement dynamic hedging strategies that adapt to market changes in real-time.

- Utilize currency options to create buffers against unfavorable rate swings.

- Focus on fundamental and technical analysis to pinpoint entry and exit points effectively.

| Strategy | Benefit | Risk Level |

|---|---|---|

| Currency Diversification | Reduced portfolio volatility | Low |

| Dynamic Hedging | Responsive risk management | Moderate |

| Use of Options | Protection against large swings | Moderate |

Maintaining flexibility in asset allocation is equally important,allowing investors to rebalance portfolios swiftly in reaction to market signals. Employing forward contracts or swap agreements can also provide predictability against currency exposure, locking in rates to avoid disruptive surprises. Strategically combining these tools can furnish a robust defense against currency market turbulence while positioning portfolios to capitalize on emerging opportunities.

to sum up

As global markets continue to navigate a complex economic landscape, the latest movements underscore the interplay between investor sentiment, currency fluctuations, and sector-specific dynamics.With megacap stocks showing renewed strength and the dollar’s rally losing momentum, analysts will be watching closely to see how these trends evolve amid ongoing geopolitical and monetary developments. Stay tuned for further updates as the market reacts to the unfolding economic narrative.