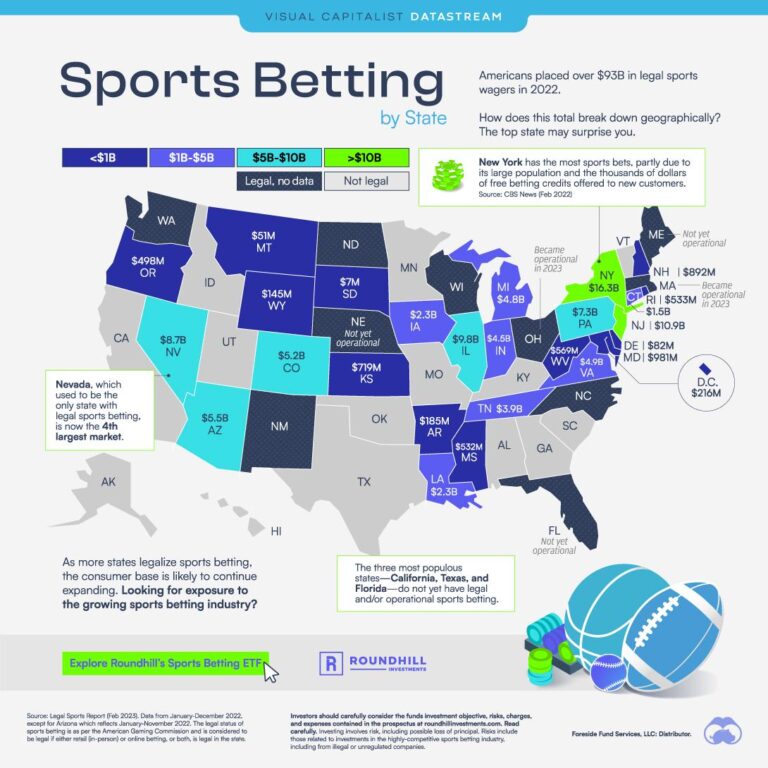

As the surge of sports betting sweeps across the United States, reshaping the landscape of both professional sports and gambling industries, New York remains noticeably behind its peers. While numerous states have rapidly embraced and regulated sports wagering, reaping significant economic and entertainment benefits, New York’s regulatory and legislative hesitations have slowed its entry into the booming market. This lag not only raises questions about lost revenue opportunities but also highlights the complex challenges the state faces in balancing regulation, consumer protection, and economic growth. The Daily Orange explores the factors contributing to New York’s cautious stance and what it could mean for the future of sports betting in the Empire State.

Sports Betting Expansion Sweeps Across the United States Leaving New York Behind

As states across the nation embrace the surge of legalized sports betting, New York remains a curious outlier, grappling with regulatory roadblocks and political hesitation. While more than 30 states have launched their own sports betting markets, millions of New Yorkers still lack legal access to this booming industry. The delay not only stifles potential revenue streams critical for state budgets but also leaves local sports fans turning to offshore and unregulated platforms, raising concerns about consumer protection and lost tax income.

Key factors contributing to New York’s lag include:

- Complex legislative negotiations that have repeatedly stalled progress in Albany.

- Opposition from influential interest groups worried about potential social impacts.

- Concerns over existing casino agreements and how sports betting might affect customary gambling revenue shares.

This hesitation contrasts sharply with states like New Jersey and Pennsylvania, where rapid market growth has generated hundreds of millions in tax revenue within just a few years.

| State | Launch Year | Annual Sports Betting Revenue (2023) |

|---|---|---|

| New Jersey | 2018 | $450M |

| Pennsylvania | 2019 | $350M |

| Illinois | 2020 | $290M |

| New York | — | $0 (Pending) |

Economic and Regulatory Challenges Slowing New York’s Sports Betting Progress

New York’s journey toward legalized sports betting is hindered by a complex web of economic and regulatory obstacles. While neighboring states embrace streamlined frameworks, New York faces a labyrinth of licensing requirements, high tax rates, and stringent operational prerequisites that deter potential operators. The state’s tax structure imposes a revenue share as high as 51%, the steepest in the nation, creating a significant barrier for sportsbooks aiming to establish a enduring presence. Additionally, the fragmented approach to licensing leads to a slower rollout of sportsbooks, curbing the market’s growth potential and consumer options.

Regulatory complications extend beyond taxes, with ongoing debates over market access and tribal gaming rights adding layers of uncertainty. Negotiations between state lawmakers and tribal casinos have delayed final approval for several key operational licenses. The following table highlights the stark contrast in regulatory environments among five leading states:

| State | Tax Rate (%) | Licensing Process | Market Launch |

|---|---|---|---|

| New York | 51 | Complex, Multiple Licenses | Delayed |

| New Jersey | 8.5 | Streamlined Single License | Established |

| Pennsylvania | 36 | Moderate Complexity | Growing |

| Colorado | 15 | Simplified | Rapid Expansion |

| Illinois | 15 | Unified Licensing | Rapid Expansion |

- High tax rates discourage new entries and limit investment.

- Complex licensing slows the approval process for sportsbooks.

- Tribal negotiations introduce uncertainty and delay operations.

- Consumer access remains limited compared to other markets.

Impact on Local Businesses and Potential Revenue Losses in New York

Local businesses in New York are feeling the pinch as sports betting legalization drags its heels. Unlike neighboring states that have capitalized on the burgeoning market, New York’s hesitation has left sportsbooks, bars, and entertainment venues scrambling to attract customers without the added draw of legalized betting. This delay not only affects business traffic but also curtails partnerships with sportsbooks that boost revenues through promotions and sponsorships.

Experts estimate potential revenue losses in the hundreds of millions annually, impacting various sectors from hospitality to retail. Some key consequences include:

- Reduced foot traffic in casinos and sports bars

- Missed advertising and sponsorship opportunities

- Loss of employment growth in ancillary industries

| Sector | Estimated Annual Loss |

|---|---|

| Hospitality & Bars | $120M |

| Sports Venues | $75M |

| Retail Merchants | $45M |

Policy Recommendations for Accelerating Sports Betting Legalization in New York

To unlock the economic and social benefits of regulated sports betting, New York’s policymakers must adopt a strategic approach that balances robust regulation with market accessibility. Key recommendations include:

- Streamlining the licensing process to attract diverse operators, fostering competition and innovation.

- Implementing strong responsible gambling measures early on to ensure consumer protection and public confidence.

- Establishing clear tax frameworks that incentivize investment while generating significant public revenue.

Moreover, legislators should consider collaborative stakeholder engagement—including industry experts, tribal partners, and consumer advocates—to create tailored policies that address New York’s unique market landscape. A phased rollout of retail and mobile platforms, supported by ongoing data analysis, will allow for adaptive regulatory responses and maximize long-term success.

| Policy Focus | Suggestion | Expected Outcome |

|---|---|---|

| Licensing | Fast-track approval for qualified operators | Increased market participation |

| Consumer Protection | Mandatory responsible gambling tools | Reduced addiction risks |

| Taxation | Competitive tax rates with transparency | Higher revenue,sustained growth |

To Conclude

As sports betting continues its rapid expansion across the United States,New York’s slower pace in legalizing and regulating the market stands out amid a growing national trend. While neighboring states reap economic benefits and increased tax revenues, New York faces mounting pressure to modernize its approach. The coming months will be critical in determining whether the state can catch up and capitalize on the booming industry or risk falling further behind.