As the new school year approaches,families in five states can take advantage of sales tax holidays on school supplies this week,providing a timely possibility to save on essential items. USA Today has compiled a full list of the participating states and key details, offering parents and students crucial information to ease back-to-school shopping costs.

States Offering Sales Tax Holidays on School Supplies This Week

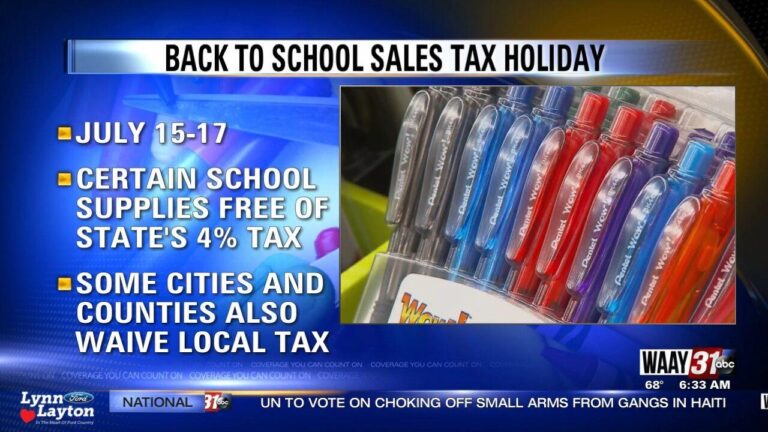

This week,five states are providing shoppers with a welcome break on back-to-school expenses through sales tax holidays specifically aimed at school supplies. These tax-free periods allow families to purchase essentials such as notebooks,backpacks,pens,and calculators without the added state sales tax,often resulting in meaningful savings ahead of the new school year.

Below is a swift overview of the participating states along with their specific dates and eligible items. Shoppers are encouraged to check local guidelines, as the criteria for tax exemptions—such as price limits or product categories—can vary:

- Alabama: August 5–7; includes clothing and school supplies under $100

- Florida: August 4–6; covers school supplies priced at $15 or less

- Mississippi: August 5–7; covers general school supplies

- Missouri: August 5–7; includes most school-related items

- Virginia: August 4–6; applies to specific school supplies under $20

| State | Tax Holiday Dates | Price Limit | Eligible Items |

|---|---|---|---|

| Alabama | Aug 5-7 | $100 | Clothing, school supplies |

| Florida | Aug 4-6 | $15 | School supplies |

| Mississippi | Aug 5-7 | No limit | School supplies |

| Missouri | Aug 5-7 | No limit | School-related items |

| Virginia | Aug 4-6 | $20 | School supplies |

Key Savings Opportunities During the Tax Holiday Period

During the tax holiday window, families can maximize their savings as essential school supplies are exempt from sales tax in participating states. This opportunity extends beyond just notebooks and pens; many states include categories such as backpacks, calculators, and even certain electronics. To make the most of these savings, shoppers should focus on:

- Basic school necessities like binders, rulers, and glue sticks.

- Tech accessories

- Clothing and footwear

It’s critically important to check each state’s specific rules as the list of eligible items varies. Some states cap the purchase amount per item, while others impose a total spending limit on tax-exempt purchases. Below is a quick overview of what you can expect in customer savings per state, helping to prioritize shopping plans efficiently:

| State | Typical Savings | Items Included |

|---|---|---|

| Texas | Up to 8.25% | School supplies & apparel under $100 |

| Florida | 6% | Clothes, shoes & supplies under $75 |

| Virginia | 5.3% | School supplies & computers |

| Missouri | 4.225% | School supplies only |

| Ohio | 5.75% | Clothing, supplies under $75 |

How to Maximize Your Budget on School Essentials

Stretching your budget on back-to-school essentials requires more than just shopping during sales tax holidays. Prioritize your purchases by creating a checklist of must-have items and distinguishing them from nice-to-have extras.Focus on durable backpacks, quality notebooks, and reusable water bottles to save money in the long run. Combining these strategic buys with discounted items during the tax holiday weeks can definitely help parents and students secure top supplies without overspending.

Another savvy approach is to leverage both physical and online store promotions. Many retailers offer exclusive bundle deals or additional discounts alongside the tax-free days. Below is a quick breakdown of smart shopping tactics to consider:

- Buy in bulk: Share or split costs with friends on frequently used items like pens or folders.

- Use price comparison apps: Ensure you’re getting the best deal on essential items.

- Check for school-specific requirements: Avoid buying unnecessary or non-compliant supplies.

- Opt for multi-purpose tools: Items like combination calculators or all-in-one stationery kits reduce overall costs.

| Category | Smart Purchase Tips | Expected Savings |

|---|---|---|

| Backpacks | Look for warranties and water-resistant fabrics | 15-25% |

| Writing Supplies | Buy multi-packs and avoid single-item purchases | 20-30% |

| Tech Gadgets | Choose refurbished or certified pre-owned models | 10-40% |

Tips for Shopping Smart and Avoiding Common Pitfalls

Plan ahead to maximize your savings during school supply sales tax holidays. Make a detailed list of what you actually need to avoid impulse purchases that can quickly add up. Prioritize the essentials such as notebooks, backpacks, or pens, and compare prices in-store and online before heading out. Don’t forget to check if your favorite stores offer additional discounts or rewards programs during the holiday, as these can stack with tax savings for even greater benefits.

Be aware of common pitfalls like confusing which items qualify for tax exemptions. Many states exclude electronics or clothing, so refer to official guidelines before shopping. When buying in bulk, verify the quality of products to ensure durability throughout the school year—cheap supplies often cost more in the long run. Use this table as a quick reference guide to common do’s and don’ts for smart shopping during these events:

| Do | Don’t |

|---|---|

| Check tax holiday dates in your state | Assume all school items are tax-free |

| Set a strict budget | Buy supplies just because they’re on sale |

| Look for manufacturer coupons | Ignore product quality and brand reviews |

| Shop early to avoid limited stock | Wait until last minute, risking sold-out essentials |

Wrapping Up

As the back-to-school season approaches, shoppers in these five states can take advantage of sales tax holidays to save on essential school supplies. Whether stocking up on backpacks, notebooks, or art materials, these temporary tax breaks offer a timely financial reprieve for families. Be sure to check your state’s specific dates and eligible items to maximize savings during this limited window. For the full list and detailed guidelines, refer to the official state resources or visit the USA Today website.