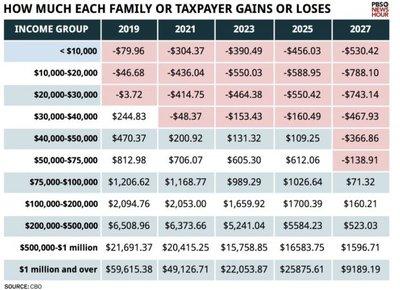

The recently proposed G.O.P. tax bill has sparked intense debate across the nation, as critics warn it could disproportionately impact the lowest earners while providing significant benefits to the wealthiest Americans. According to an analysis by The New York Times, the legislation’s changes to tax rates, deductions, and credits raise concerns that economic inequality may deepen. As lawmakers push to finalize the bill, questions linger about its potential effects on middle- and low-income families struggling to make ends meet, positioning the debate at the heart of broader discussions over fairness and fiscal responsibility.

G.O.P. Tax Bill’s Impact on Low Income Families Analyzing the Redistribution of Wealth Under the Proposed Legislation Potential Long-Term Economic Consequences for Middle Class Workers Policy Recommendations to Mitigate Adverse Effects on Vulnerable Populations

The G.O.P. tax bill has sparked widespread concern due to its potential to reshape the economic landscape in ways that disproportionately disadvantage low income families.The proposed legislation appears to concentrate benefits among the wealthiest, while offering limited relief to those earning the least. Key provisions, such as the reduction in the top marginal tax rate and the elimination of certain deductions, may deepen existing inequalities by enabling high-income earners to accumulate more wealth, whereas many low income households face stagnant or increased tax burdens. This shift could exacerbate financial instability among vulnerable populations, undermining access to essential services and opportunities for upward mobility.

Further analysis highlights potential long-term consequences for middle-class workers, including slowed wage growth and diminished purchasing power. To address these challenges, policymakers should consider targeted measures aimed at cushioning the impact on lower earners. Recommended actions include:

- Strengthening Earned Income Tax Credits to increase take-home pay for working families.

- Maintaining or enhancing deductions for child care and education expenses to reduce out-of-pocket costs.

- Implementing phased tax relief that gradually adjusts obligations so no group faces abrupt financial strain.

| Income Group | Estimated Average Tax Change | Potential Impact |

|---|---|---|

| Low Income | + $300 | Increased Financial Strain |

| Middle Class | + $150 | Reduced Disposable Income |

| High Income | – $10,000 | Significant Tax Relief |

Concluding Remarks

As the debate over the G.O.P. tax bill continues, its potential consequences remain a point of contention among lawmakers, economists, and the public. While proponents argue that the legislation could stimulate economic growth, critics warn that it may exacerbate income inequality by disproportionately benefiting the wealthiest Americans at the expense of lower-income earners. The coming months will reveal the full impact of these changes on the nation’s economic landscape, underscoring the ongoing tensions in shaping tax policy that aims to balance growth with fairness.