Wall Street is pouring billions of dollars into artificial intelligence data centers, betting that these high-tech hubs will fuel the next wave of innovation and economic growth. Major financial institutions and investment firms are aggressively funding the construction and expansion of facilities designed to support AI workloads, signaling strong confidence in the sector’s future. Yet, as the pace of investment accelerates, questions arise about whether this surge is grounded in solid fundamentals or if it reflects a burgeoning bubble reminiscent of previous tech frenzies. This analysis examines the forces driving the AI data center boom on Wall Street and explores the risks that may lie ahead.

Wall Street’s Massive Bet on Artificial Intelligence Infrastructure

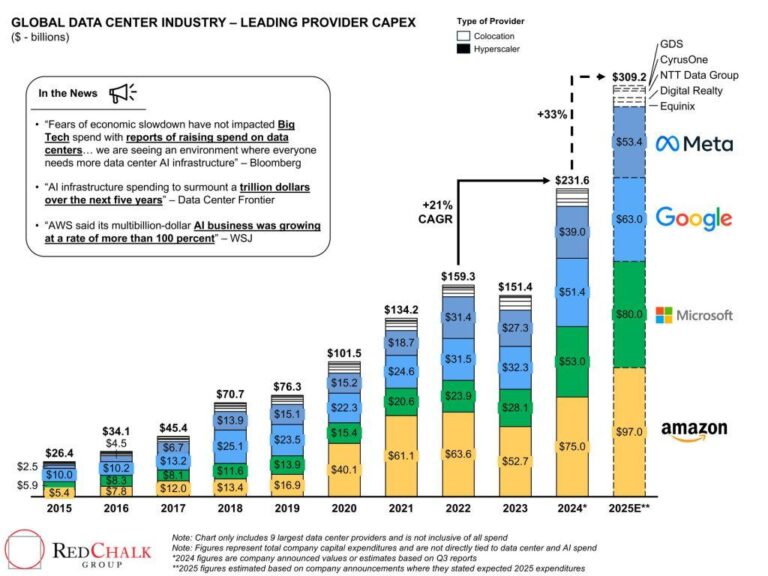

Wall Street’s fervent focus on artificial intelligence infrastructure signals a seismic shift in investment priorities. Hedge funds, venture capitalists, and major financial institutions are funneling unprecedented capital into A.I. data centers, betting on their pivotal role in powering the next generation of machine learning and deep learning applications. This surge in funding is driven by projections that A.I. workloads will increase by over 500% in the next five years, necessitating new facilities with cutting-edge GPUs, specialized cooling systems, and robust energy supplies. Firms are not only building new data centers but also acquiring existing ones, creating a frenzy reminiscent of the late 1990s dot-com boom.

- Geographic hotspots: Northern Virginia, Silicon Valley, and parts of Texas are seeing explosive growth in data center developments.

- Technological arms race: Companies are competing fiercely to deploy the latest AI-specific hardware, including quantum accelerators and AI chips.

- Energy challenges: The unprecedented power demands of these centers raise concerns about sustainability and local grid capacity.

| Investor Type | Capital Deployed (2023) | Projected Growth (2024-2028) |

|---|---|---|

| Hedge Funds | $15B | +35% |

| Venture Capital | $10B | +50% |

| Institutional Investors | $20B | +40% |

Despite the optimism, some analysts warn that the enthusiasm may be inflating a risky bubble. The rapid pace of construction has led to concerns about overcapacity in certain regions, while the extremely high operational costs and expensive hardware upgrades pose financial challenges.Additionally, geopolitical tensions around semiconductors and supply chains could disrupt the steady flow of necessary components. Critics argue that while A.I.data centers are crucial, the market’s current valuation might be outpacing realistic growth, creating a situation ripe for correction. Investors are urged to weigh the potential returns against the risks inherent in this high-stakes technology race.

Examining the Risks Behind the Data Center Boom

Behind the rapid expansion of A.I. data centers lies a complex web of financial and operational risks that frequently enough go unnoticed amid the frenzy. Although investors are pouring billions into infrastructure, the sector grapples with important challenges such as soaring construction costs, escalating energy consumption, and the delicate balance of supply and demand. The risk of overbuilding looms large, especially as some data centers remain underutilized due to shifting software requirements and the unpredictable pace of A.I. adoption.

Key concerns amplifying the risk include:

- Volatile hardware market prices impacting CAPEX

- Regulatory headwinds regarding energy and emissions

- Potential technological obsolescence amid fast-paced innovation

- Concentration of demand among only a handful of large A.I. firms

| Risk Factor | Impact | Mitigation Strategy |

|---|---|---|

| Energy Costs | Raises operational expenses | Investment in renewable energy |

| Underutilization | Reduces ROI | Flexible leasing agreements |

| Hardware Obsolescence | Requires frequent upgrades | Modular infrastructure design |

How Market Overenthusiasm Could Fuel a New Tech Bubble

The surge in investments towards A.I. data centers has drawn parallels to past tech bubbles, where optimism outpaced reality. Wall Street’s fervent backing is driving massive capital inflows, fueling the rapid expansion of data center infrastructure specifically designed to support artificial intelligence workloads. However, the exuberance in valuations raises critical questions about sustainability. Investors are betting heavily on expected growth trajectories without fully considering potential market saturation, operational costs, or the evolving competitive landscape.

Key factors contributing to this overenthusiasm include:

- Skyrocketing demand projections for A.I.-powered applications.

- Heavy leverage and speculative financing among developers.

- Limited transparency on long-term profitability of new data center projects.

- Rapid technology shifts perhaps rendering current investments obsolete.

| Indicator | Current Status | Potential Risk |

|---|---|---|

| Data Center Valuations | Up 150% in 18 months | Overpriced assets |

| Investor Sentiment | Extremely bullish | Market correction |

| Tech Innovation Pace | Rapid | Obsolescence risk |

Strategies for Investors Navigating the AI Data Center Surge

As artificial intelligence continues to fuel unprecedented demand for data centers, investors face the challenge of distinguishing enduring growth from speculative fervor. A prudent approach involves diversifying investments across multiple technology sectors, rather than concentrating solely on AI-focused data center companies. This strategy helps mitigate risk by balancing exposure to firms involved in hardware manufacturing, cloud infrastructure, and semiconductor growth, all integral to the AI ecosystem. Moreover, analyzing companies with clear earnings and robust balance sheets can shield portfolios from volatility triggered by hype-driven market swings.

Investors should also pay close attention to regulatory frameworks and geopolitical dynamics shaping the data center landscape. Factors like energy consumption policies and supply chain disruptions can significantly impact profitability levels. To navigate these complexities, consider the following tactics:

- Monitor technological innovations: Focus on companies leading in efficient AI processing and cooling technologies to ensure long-term viability.

- Evaluate real estate exposure: Data centers require prime locations with reliable infrastructure—companies with diversified global footprints may offer better risk management.

- Watch for valuation signals: Compare price-to-earnings ratios against ancient averages to uncover potential overvaluation.

| Key Metric | AI Data Center Leaders | Broader Tech Sector |

|---|---|---|

| Revenue Growth (YoY) | 25-40% | 10-20% |

| Operating Margin | 15-25% | 20-30% |

| P/E Ratio | 40-60x | 25-35x |

To Conclude

As Wall Street continues to pour capital into AI data centers, the technology sector stands at a critical juncture. While the promise of artificial intelligence drives unprecedented investment and innovation, questions about market sustainability and the potential for overvaluation linger. Industry leaders and investors alike must navigate a complex landscape where rapid growth meets inherent risk, determining whether these data centers will underpin the next wave of technological advancement or become the heart of an emerging bubble. Only time will reveal if the substantial bets placed today will yield transformative progress or cautionary lessons for the future.