Between 2018 and 2023, credit insecurity has emerged as a growing concern for millions of Americans, reflecting deeper economic challenges and shifting financial landscapes.A new report from the Federal Reserve Bank of New York sheds light on the extent and nuances of this issue, revealing how factors such as income instability, rising debt levels, and evolving credit markets have impacted consumers nationwide.As policymakers and financial institutions grapple with these trends,understanding the patterns and consequences of credit insecurity is crucial for shaping effective interventions and promoting economic resilience. This article delves into the key findings of the Federal Reserve’s analysis, exploring what credit insecurity means for American households and the broader economy in the post-pandemic era.

Credit Insecurity Trends and Demographic Disparities in the United States

Recent data indicates a persistent growth in credit insecurity among U.S. consumers from 2018 to 2023, with notable fluctuations tied to economic cycles and public policy changes. Vulnerability to credit shocks remains disproportionately high in specific segments, reflecting deep-rooted structural inequalities. Low-income households and minority communities have experienced the most acute challenges, facing limited access to affordable credit and heightened risks of default. Meanwhile, younger adults, particularly those under 35, show increasing debt reliance amid stagnant wage growth and rising living costs.

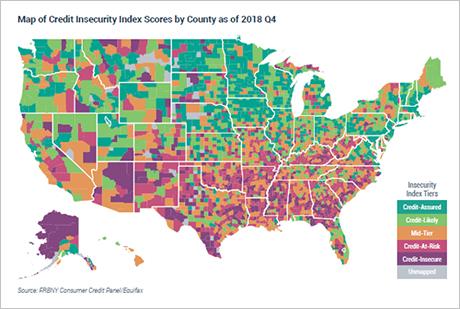

Regional disparities also underscore the uneven landscape of credit insecurity. Residents in the Southeast and Southwest regions consistently report higher rates of credit distress compared to those in the Pacific Northwest and Northeast. Factors such as employment volatility, educational attainment, and local financial infrastructure contribute to these trends. Below is a summary of recent credit insecurity indicators by demographic group:

| Demographic Group | Average Credit Insecurity Rate (%) | Primary Contributing Factors |

|---|---|---|

| Low-Income Households | 42 | Limited credit access, high debt-to-income ratios |

| Minority Communities | 38 | Discriminatory lending, wealth gaps |

| Young Adults (18-34) | 35 | Student loan burden, wage stagnation |

| Regions – Southeast | 40 | Employment instability, lower financial literacy |

| Regions – Northeast | 28 | Greater access to financial services |

Impact of Economic Shifts on Consumer Credit Health Since 2018

Since 2018, significant fluctuations in the U.S. economy have left a lasting imprint on consumer credit health. The Federal Reserve Bank of New York highlights how periods of rapid economic growth were frequently interrupted by downturns, impacting Americans’ ability to manage debt.Key indicators such as delinquencies on credit cards and auto loans showcase how borrowers rapidly adjust their repayment behavior in response to changing economic conditions. For instance, the COVID-19 pandemic triggered a sharp rise in credit delinquencies in early 2020, yet government stimulus measures and forbearance programs temporarily stabilized credit health. However, as these supports tapered off, vulnerable populations—especially those with subprime credit scores—experienced increased credit stress.

- Employment instability directly correlated to rising credit delinquencies among low-income borrowers.

- Inflationary pressures as 2021 have tightened household budgets, leading to an uptick in late payments.

- The persistent rise in interest rates has increased the cost of borrowing, complicating debt management for many.

| Year | Credit Delinquency Rate (%) | Unemployment Rate (%) | Inflation Rate (%) |

|---|---|---|---|

| 2018 | 3.2 | 3.9 | 2.4 |

| 2020 | 4.8 | 8.1 | 1.2 |

| 2022 | 5.1 | 3.6 | 6.2 |

| 2023 (est.) | 5.4 | 3.8 | 4.5 |

These shifts reveal the fragility of consumer credit health under varying economic pressures. Borrowers have increasingly turned to alternative financing sources, risking higher interest rates and compounding debt cycles. Financial experts warn that without targeted policy interventions aimed at stabilizing employment and controlling inflation, credit insecurity may deepen, disproportionately affecting marginalized communities. Monitoring these evolving dynamics remains critical for stakeholders seeking to foster a more resilient credit landscape in the United States.

Federal Reserve Bank of New York Analysis on Rising Financial Vulnerabilities

Recent analyses from the Federal Reserve Bank of New York reveal an alarming increase in financial vulnerabilities across various U.S. demographics between 2018 and 2023. Key factors contributing to this trend include escalating household debt, stagnating wage growth, and a higher incidence of delinquent credit accounts. These developments underscore the fragile state of financial security for many Americans, with particular impacts on younger borrowers and those in lower income brackets. The report highlights how the convergence of these pressures threatens to undermine economic recovery efforts and exacerbate wealth inequality nationwide.

According to the data, several critical indicators point toward escalating credit insecurity:

- Household debt levels rose by over 15% from 2018 to 2023, primarily driven by mortgage and student loan burdens.

- Delinquency rates on credit cards and auto loans increased by 20%, signaling growing repayment difficulties.

- Emergency savings declined sharply among lower-income groups, limiting financial resilience.

| Year | Average Household Debt (in $1000s) | Delinquency Rate (%) | Emergency Savings Median ($) |

|---|---|---|---|

| 2018 | 140 | 3.5 | 4,200 |

| 2020 | 155 | 4.1 | 3,650 |

| 2023 | 161 | 4.9 | 3,000 |

Policy Recommendations to Address Growing Credit Challenges

To mitigate the alarming rise in credit insecurity, policymakers must prioritize expanding access to affordable credit while protecting consumers from predatory practices.Enhancing regulatory oversight on high-interest lending and establishing stringent clarity requirements for credit products can curtail exploitative behavior that disproportionately affects low-income borrowers. Together, bolstering financial literacy programs—particularly in underserved communities—can empower individuals to make informed borrowing decisions, reducing default risks and promoting healthier credit profiles.

Another critical strategy involves modernizing credit reporting systems to reflect a more comprehensive view of consumer financial behavior. This includes integrating alternative data sources such as rent, utility payments, and subscription services, which can definitely help nontraditional borrowers build stronger credit histories. The table below outlines key policy actions and their projected impact on credit stability:

| Policy Action | Expected Outcome | Target Group |

|---|---|---|

| Stricter lending regulation | Reduced high-cost loans | Vulnerable borrowers |

| Financial education initiatives | Improved credit decision-making | Young adults & low-income |

| Inclusion of alternative data | Expanded credit access | Thin-file consumers |

- Promote fair lending policies that reduce systemic barriers and discrimination.

- Support community-based credit counseling centers with public funding.

- Encourage innovation in fintech solutions to offer personalized credit risk assessment.

In Summary

As the data from the Federal Reserve Bank of New York highlights, credit insecurity remains a pressing issue for millions of Americans between 2018 and 2023. Fluctuations in credit access and repayment challenges underscore the ongoing financial vulnerabilities faced by households across the country.Addressing these concerns will require coordinated efforts from policymakers, financial institutions, and community organizations to foster economic stability and inclusive growth in the years ahead.