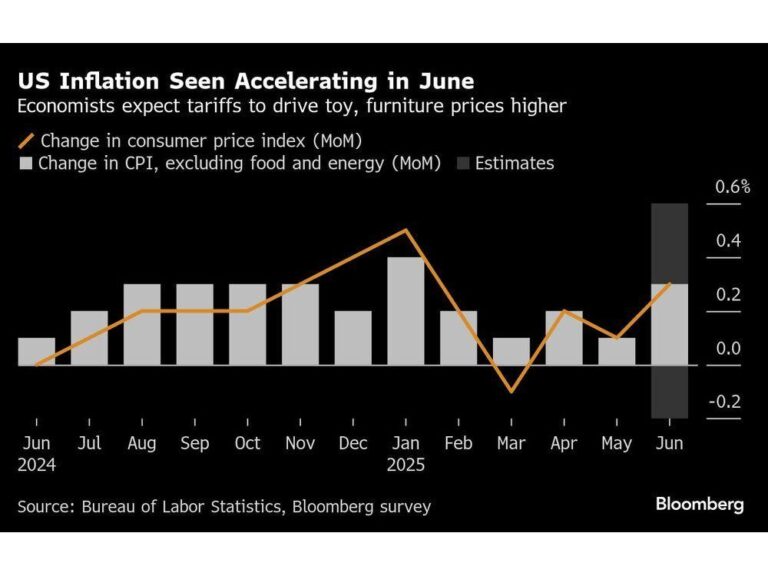

In June, inflation in the United States surged at its fastest pace in months, fueled in part by the ongoing impact of tariffs imposed during the Trump administration. According to the latest data released this week, consumer prices rose more sharply than economists had anticipated, underscoring persistent pressures on the economy as households continued to grapple with higher costs for goods and services. The New York Times examines how these tariff-driven price increases have contributed to the accelerating inflation and what this means for policymakers and consumers moving forward.

U.S.Inflation Surges in June Driven by Increased Tariff Costs

June’s inflation numbers revealed a sharp uptick largely attributed to the ripple effects of tariffs imposed during the previous administration. The increased cost of imported goods, particularly from China and other key trade partners, fueled price surges across multiple sectors—from electronics to household items. Economists point out that the tariffs, originally intended to bolster domestic manufacturing, inadvertently transferred costs directly to consumers, contributing to a meaningful monthly inflation spike.

Behind these rising prices, several products saw disproportionate increases, emphasizing the pervasive impact of the tariffs:

- Consumer electronics prices rose by an average of 4.5%

- Appliance costs increased by 3.8%

- Building materials and hardware went up by nearly 6%

| Category | Price Increase (June) | Tariff Impact (%) |

|---|---|---|

| Electronics | 4.5% | 70% |

| Appliances | 3.8% | 65% |

| Building Materials | 6.0% | 75% |

| Clothing | 2.3% | 40% |

Analysts warn that unless tariff policies are revisited, consumers should expect ongoing price pressures even as the Federal Reserve attempts to stabilize inflation through monetary policy. The persistence of tariff-driven inflation adds complexity to economic recovery efforts, forcing businesses and households to adapt to higher operational and living costs.

Analysis Reveals Trump-Era Tariffs as Key Factor in Rising Consumer Prices

New economic data highlights the enduring impact of tariffs imposed during the Trump administration on the recent spike in consumer prices. These tariffs, initially intended to protect domestic industries, have inadvertently increased costs for a wide range of imported goods. Analysts link the tariffs to heightened expenses across multiple sectors, contributing notably to inflationary pressures that were recorded in June.

Key findings from the analysis include:

- Significant price hikes in electronics,apparel,and household appliances attributed to tariff-related import costs.

- Supply chain disruptions that amplified the effects of tariffs, further driving up retail prices.

- Consumer spending patterns shifting as buyers face higher out-of-pocket expenses.

| Sector | Average Price Increase | Tariff Impact (%) |

|---|---|---|

| Electronics | 8.7% | 65% |

| Apparel | 6.4% | 58% |

| Household Goods | 7.1% | 52% |

Sector Breakdown Shows Consumer Goods and Raw Materials Hit Hardest

The latest data reveals that the inflationary pressures in June were glaringly uneven across various sectors of the U.S. economy. Consumer goods and raw materials sustained the most severe impact, primarily driven by the tariffs enacted during the previous administration. Essential items ranging from household products to industrial inputs rose sharply as import costs escalated, feeding into broader price increases felt by businesses and consumers alike.

Key influencers in this dynamic include:

- Household Appliances: Prices surged close to 7% year-over-year due to costly imports.

- Metal Commodities: Steel and aluminum prices jumped by nearly 8%, reflecting supply chain constraints and tariff costs.

- Packaging Materials: Significant cost spikes increased operational expenses for manufacturers.

| Sector | June Price Increase (%) | Primary Driver |

|---|---|---|

| Consumer Goods | 5.9% | Tariffs on imports |

| Raw Materials | 7.4% | Increased import costs |

| Energy | 3.2% | Global supply constraints |

Experts Recommend Policy Revisions to Mitigate Tariff-Induced Inflation Impact

Considering the recent surge in inflation attributed to tariffs introduced during the previous administration, policy experts are urging a comprehensive review and overhaul of current trade policies. Many argue that sustained tariff measures have disrupted supply chains and increased manufacturing costs across a wide array of sectors, ultimately burdening consumers with higher prices. Economists emphasize that without strategic adjustments, these inflationary pressures risk entrenching long-term economic challenges, particularly for low- and middle-income households.

Key recommendations include:

- Gradual reduction of tariff rates to alleviate cost-push inflation

- Enhanced diplomatic engagement to resolve trade disputes amicably

- Implementation of targeted subsidies or relief programs for vulnerable industries

- Investment in domestic production capabilities to reduce dependence on imported goods

| Policy Action | Expected Outcome | Short-Term Impact |

|---|---|---|

| Tariff Reduction | Lower input costs for manufacturers | Moderate inflation decline |

| Trade Negotiations | Stabilized supply chains | Improved market confidence |

| Targeted Subsidies | Support for key industries | Short-term cost relief |

| Domestic Production Boost | Reduced import reliance | Long-term economic resilience |

Key Takeaways

As inflation continued to accelerate in June,the impact of tariffs implemented during the Trump administration remains a significant factor driving up consumer prices. Economists and policymakers will be closely monitoring these trends as they grapple with the challenges of balancing economic growth and price stability. The coming months will be critical in assessing whether inflationary pressures ease or persist, shaping the trajectory of the U.S. economy going forward.