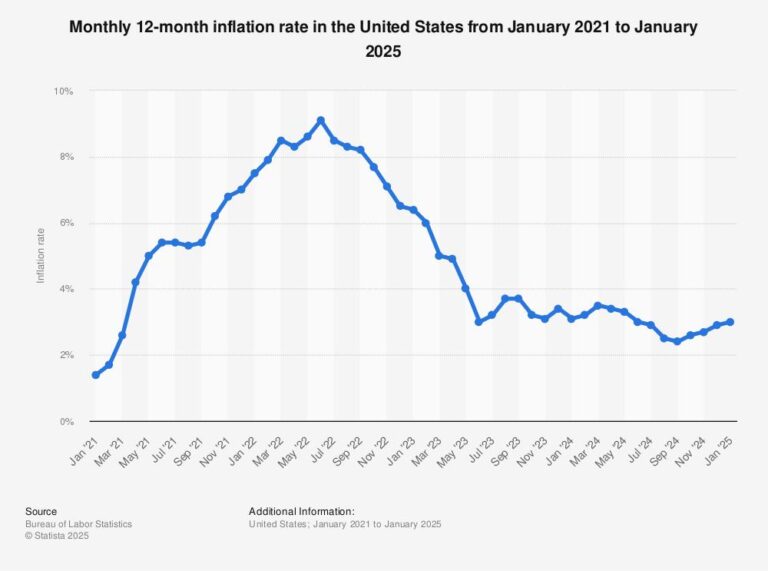

The latest Consumer Price Index (CPI) report underscores a persistent trend of subdued inflation in the United States, suggesting that recent tariff measures have had a limited effect on overall price levels. As policymakers and economists closely monitor inflation data for signs of economic pressure,the restrained rise in consumer prices signals a resilient economic landscape despite ongoing trade tensions. This progress, highlighted in a recent New York Times analysis, offers critical insights into the complex interplay between tariffs and inflation dynamics in the current economic climate.

CPI Data Indicates Steady Inflation Despite Global Economic Pressures

Amid ongoing global economic uncertainties, recent Consumer Price Index (CPI) figures reveal a surprisingly stable inflation surroundings in the U.S.Despite pressures from international tariff adjustments and supply chain disruptions, the data suggests that inflationary spikes have been largely contained. Key sectors such as energy and food have seen minor price fluctuations, helping to maintain an overall steady inflation rate.

The resilience against tariff-induced inflation is attributed to several factors,including:

- Effective supply chain adjustments by American companies mitigating cost pass-throughs to consumers.

- Moderate wage growth keeping consumer demand steady without overheating the market.

- Government interventions aimed at cushioning vulnerable sectors from imported cost shocks.

| Category | Annual CPI % Change | Impact |

|---|---|---|

| Energy | +2.3% | Moderate |

| Food | +1.8% | Low-Moderate |

| Transportation | +0.9% | Minimal |

| Housing | +3.1% | Steady |

Limited Effect of Tariffs Suggests Supply Chain Resilience

Recent data underscores the surprising resilience of supply chains in the face of ongoing tariff pressures. Despite expectations that tariffs would significantly drive up consumer prices, the latest Consumer Price Index (CPI) figures reveal only a limited effect on inflation. Economists attribute this muted impact partly to companies’ strategic diversification of sourcing and increased domestic manufacturing efforts,which have collectively softened the cost shocks typically passed on to consumers.

Key factors contributing to supply chain resilience include:

- Expanded supplier networks beyond traditional trade partners

- Accelerated adoption of automation and technology in logistics

- Enhanced inventory management aimed at mitigating price volatility

- Government incentives supporting localized production

| Factor | Impact on Supply Chain | Effect on Inflation |

|---|---|---|

| Supplier Diversification | Reduced dependency on tariff-affected regions | Minimized cost pass-through |

| Automation & Technology | Lowered operational costs | Contained price increases |

| Inventory Management | Stabilized supply availability | Smoothed price fluctuations |

Consumer Spending Patterns Highlight Stability in Key Sectors

Recent data reveals a consistent pattern in consumer spending,underscoring resilience in several major sectors despite ongoing economic pressures. Key categories such as housing, healthcare, and groceries have demonstrated steady demand, suggesting that consumers are prioritizing essentials and maintaining their purchasing habits. This behavior plays a crucial role in tempering overall inflation, as stable consumption in these sectors offsets volatility seen elsewhere.

Delving deeper into the spending trends, the following points highlight sectors showing marked stability:

- Housing: Rental prices and home utilities have seen minor fluctuations, reflecting prolonged demand amid supply constraints.

- Healthcare: Expenditures remain consistent as medical services and pharmaceuticals continue to be essential.

- Food and Beverage: Groceries maintain steady sales, indicating cautious but sustained consumer confidence.

| Sector | Quarterly Change | Impact on CPI |

|---|---|---|

| Housing | +0.3% | Moderate upward pressure |

| Healthcare | +0.2% | Stable influence |

| Food and Beverage | +0.1% | Neutral |

Policy Experts Urge Cautious Approach Amid Ongoing Market Uncertainties

Amid persistent economic headwinds,leading policy analysts emphasize the need for vigilance in navigating today’s volatile markets.Despite data indicating that the Consumer Price Index (CPI) reflects restrained inflationary pressures, the intricacies of tariff implementations remain a focal point of concern. Experts caution that although tariff impacts appear limited for now, unforeseen geopolitical shifts and supply chain disruptions could quickly alter the economic landscape.

Key considerations raised by these policy experts include:

- Maintaining flexible monetary strategies to adapt swiftly to inflation fluctuations.

- Monitoring international trade policies closely to anticipate tariff-driven cost pressures.

- Prioritizing data-driven decision-making to balance growth with inflation control.

| Factor | Current Impact | Potential Risk |

|---|---|---|

| Tariff Policy | Minimal inflationary effect | Escalation due to trade disputes |

| Supply Chain | Stabilizing post-pandemic | Disruptions from geopolitical tensions |

| Monetary Policy | Gradual tightening | Overcorrection risking growth slowdown |

Insights and Conclusions

the latest Consumer Price Index data underscores a continued moderation in U.S. inflation, suggesting that the anticipated effects of tariffs on consumer prices have been more contained than initially feared. While challenges remain, the muted inflation readings provide some reassurance to policymakers and markets navigating an evolving economic landscape. As the situation develops, close attention will be paid to upcoming data releases and policy responses to better understand the long-term implications for inflation and economic growth.